The Indian real-estate sector like any other sector has seen an interesting turn of events on account of Covid-19. With the onset of the year, the real-estate market was set for a quick comeback buoyed by low-interest rates, a fall in the number of covid-19 cases, news of vaccine rollout, stamp duty cuts, and a slew of attractive payment options. However, as we saw a steep rise in the number of cases from April 2021, the nation suffered its worst-ever crisis and as a result, the real estate market also plunged. As normalcy is restored, the real-estate market shows signs of optimism.

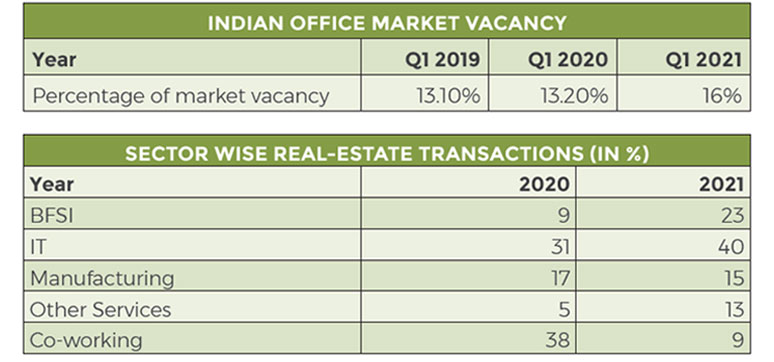

The real-estate stocks remain bullish with signs of demand revival in both residential as well as commercial space. The Indian real-estate market shows strong signs of optimism and recovery in 2021 after a series of headwinds which include a 2016 surprise cash ban, bad-loan crisis, and the covid-19 pandemic.

THE INFRASTRUCTURE PUSH IN 2020-21

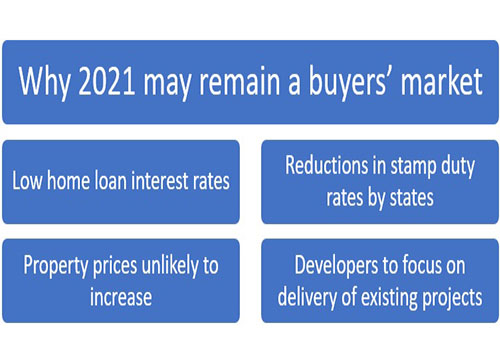

The Indian real-estate market constitutes around 8 percent of the GDP and is the second-largest employment creator after agriculture. With a workforce of over 40 million directly dependent on the sector, strained real estate is bound to have a cascading effect on the economy. As the market shows more favorable economic trends, the government and the industry need to work in tandem on creating a strong infrastructure pipeline. While RBI’s accommodative stance alongside liquidity injection has eased home loan rates, further concentrated efforts like stamp duty reduction in states of Karnataka, Maharashtra, and Delhi have eased consumer woes. With the Model Tenancy Act (MTA) expected to be operational soon, the Indian rental market looks to become standardized thus drawing institutional players to this category.

THE BALANCING ACT

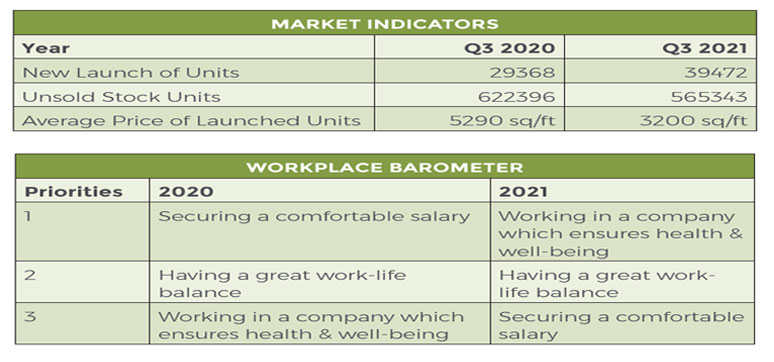

What’s also important is taking care of the employees and vendors both in terms of bodily and financial health. Another step is offering vaccine packages to employees amidst such a medical crisis.

Government and the industry need to work hand in hand to develop technological innovation. Via subsidies and policy incentives, the latest technological developments should be deployed, and a hybrid workflow should be adopted.

The use of video conferencing and online visual tours should be looked upon as an alternative to entice new consumers. Adoption of data mining techniques to unlock consumer buying patterns and habits is the way to keep the guesswork out and truly understand consumer purchase behavior.

Backward and forward integration, optimization of operational workflow, and research led by academic institutions should also be focused upon. While there is no dearth of housing demand in the country, aggressive sales and marketing planning without any incremental costs is required.

WHAT’S NEXT FOR THE REAL ESTATE MARKET?

Looking ahead, this time around, the real-estate sector will remain risk-averse. Firstly, with controlled cases, most rating agencies have not cut down on the prior aggressive growth numbers of India.

Despite the cyclic slowdowns, the structural demand is robust which stems from the rise in disposable income, young demographics, and a large urban-centric population. Secondly, plenty of first-time homebuyers is looking out for a home. Similar is the case with households looking to move out and obtain larger houses. Thirdly, lower housing loan rates further attract consumers and add impetus to the market.

The economic outlook for FY 2022, looks promising with 360 Realtors view research suggesting an overall positive economic outlook and most rating agencies correcting the forecast GDP numbers in the range of 8 to 9.5 percent.

The home-buying sentiment looks sold at 30.7 percent of buyers looking to buy a home. The 360 realtor survey also suggests that a visible segment in the market is looking to upgrade.

SETTING STAGE FOR GROWTH AHEAD

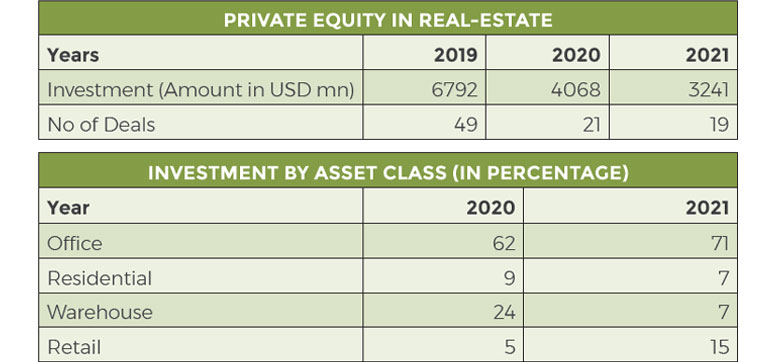

As per the India Brand Equity Foundation (IBEF), the real-estate market is expected to grow from USD 1.72 billion in 2019 to USD 9.30 billion by 2040. The ICRA estimates Indian firms to raise USD 48 billion via InVITs and REITs in 2022. Retail real-estate along with the warehousing segment attracted USD 220 million and USD 971 million in 2020 respectively and the office space segment is expected to cross USD 700 million by 2022.

THE GOVERNMENT PUSH

The government is taking several initiatives to encourage sectoral development. A tax deduction of up to Rs.1.5 lakh on interest on housing loans and tax holidays has been provided by the Union Budget of 2021-22. Under the Atma Nirbhar Bharat Package 3.0, the government has provided income tax relief measures when it comes to the primary purchase and sale of residential units of up to Rs. 2 crores.

To deal with stalled housing projects, the Cabinet has approved the setting up of an Rs.25,000 crore alternative investment fund and has also created an affordable housing fund in the National Housing Bank with a corpus of Rs.10,000 crore.

The residential sector is also expected to grow significantly with the central government aiming to build around 20 million affordable houses by 2022. Regulatory body SEBI has lowered the minimum application value for Real-estate Investment Trusts (REITs) from Rs.50,000 to Rs.10000-Rs.15,000 making the market more accessible to both small and retail investors.

INCREASED IT SPENDING

The IT spending in real estate is on an upturn. Similarly, with the anticipation of the third wave, real estate advisories look to spend more money on cloud-based services, remote working software to ensure seamless service in the face of a crisis. The use of cloud-based technologies has already illuminated real-estate players about big-data sets. Now integration with machine learning software and Artificial Intelligence (AI), the game of data analytics can help in the systematic evaluation of a large chunk of alternatives to find the best fit.

CONCLUDING THOUGHTS

Moving forward, the investment in real estate needs to be backed by long-term strategic interest to build a solid foundation for the future. Government support, industrial sector initiatives, and the use of technology can play a pivotal role in simplifying the transaction cycle, driving engagement, and improving the ROI significantly.